Try it for free for a few months and then make a decision!

Take control of your imbalance costs

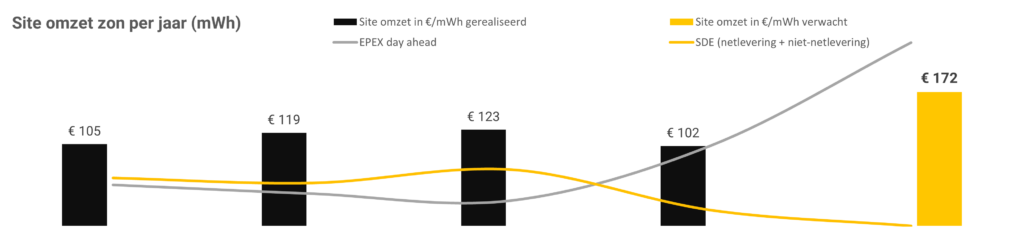

The electricity network is becoming increasingly volatile. This leads to higher costs and unwelcome surprises. Encast helps organizations with an SDE scheme to navigate through the energy transition using their measurement data.

Financial management

Financial Insight and Control

Despite the high prices, electricity is still perceived by many companies as a commodity – a product that is always available and can be obtained for a reasonably low and fixed monthly cost.

The conflict in Ukraine, climate change challenges, and other geopolitical factors have brought this stark reality to our attention: Many companies were no longer able to produce electricity profitably at the prevailing cost, a business risk that many had not adequately covered. The costs of necessary investments to become climate-neutral are not even included in this equation.

Utilizing self-generated electricity provides certainty, something that is no longer always guaranteed with the full energy grid. Self-generation is also usually more cost-effective because you do not have to pay energy taxes, transportation costs, and margins to your supplier for your own generation. In 2022, this provided an additional benefit of around €50 per MWh.

Therefore, it is essential to have a good and detailed understanding of your electricity profile and the ability to adjust it promptly. The yield from self-generation depends on multiple involved parties and factors over a period of 15 years or more. As a result, a comprehensive overview is often lacking. This makes it challenging to optimize your yield or, for instance, make further investments in charging stations or a battery.

The Encast Portal

The final yields of your installation ultimately depend on a multitude of factors. Encast brings all of this together in a clear portal to help you navigate through the energy transition.

The ultimate yield of your installation depends on various factors, including:

- SDE advances from the Netherlands Enterprise Agency (RVO). These depend on the assigned base amount you’ve applied for, the base price, and the proportion of electricity you feed back into the grid versus what you use or sell on-site.

- Potential downtime costs (due to malfunctions and maintenance).

- Provisional and final correction amounts, which are determined annually by the Netherlands Environmental Assessment Agency (PBL) and are influenced by the average market price for electricity and the profile and imbalance factor.(Utilizing forecasting that yields a lower imbalance than what’s established by the PBL can increase your yield.)

- Weather conditions and operational performance.

- The quality of advice from your energy consultant or supplier (LV) and the frequency of receiving advice.

- Savings on energy taxes, transportation costs, and your supplier’s margin when increasing your self-consumption.

- The ability to store energy in an electric vehicle or external battery and the ability to charge and discharge it.

- The actual revenue from the sale of generated electricity through your supplier, the costs they charge for this service, and the quality of their forecasting for your imbalance costs. Combining forecasts from multiple production locations can often lead to lower imbalance costs.

- And, post-assessment, the settlements that are reconciled when the final correction amount and the annual GVO compensation are determined by the PBL, and when your consumption and grid delivery are verified by CertiQ.

Many of these aspects become more transparent through Encast’s portal.

Financial Management

Financial management is possible when you have a dynamic energy contract. In the case of Encast, this typically occurs with an energy supplier where you can provide your forecast yourself (or Encast can do it on your behalf).

With a forecast, you can take a position in the day-ahead market, which trades energy for the following day. A forecast is never 100% accurate, and the difference is expressed as an imbalance.

The rates in the imbalance market of TenneT fluctuate much more significantly than those in the day-ahead market. Imbalance is becoming a growing cost for every producer. Therefore, flexibility, predictive power, and insight are becoming increasingly valuable on the grid and in the energy markets.

Earn Up to 25% Extra on a Solar Farm Through Imbalance

When there is excess electricity on the grid, TenneT curtails it, and the price on the imbalance market can become negative. This means that money is paid to consume or generate energy. This scenario is becoming increasingly common, especially during sunny weekends and holidays.

During such moments, TenneT pays parties that consume more electricity than their forecast predicts. Any organization can earn extra by significantly reducing the production from their self-generation and using additional power from the grid. Encast, based on its models, can provide control signals to respond to this situation:

Curtailment Control: If your solar farm or wind turbine is equipped with a suitable curtailment gateway (which is viable from 300 kWp), Encast can assist in shutting down your solar farm or wind turbine.

You then produce less electricity compared to the position you have taken on the Day Ahead market based on the forecast and, in theory, source additional electricity from the market, for which you are compensated once again.

In the second half of 2022, it was possible to increase revenue in this way by more than 55 euros per MWh, which amounts to roughly 25% extra for a solar farm.

Encast can also inform you through an API when it’s smart to increase or decrease your electricity consumption to earn extra on the imbalance market. Therefore, it’s wise to explore whether you can make your energy-intensive business processes more flexible and controllable. A good example of this is electric vehicle or forklift charging, adjusting freezer temperatures, or reducing consumption at certain times.

About Encast

Copyright 2023