Test een paar maanden gratis en neem dan een besluit!

Neem controle over uw netaansluiting

Het wordt steeds volatieler op het elektriciteitsnetwerk. Dat leidt tot hogere kosten en ongenode verassingen. Encast helpt organisaties om met behulp van een automatische piloot door de energietransitie heen te navigeren.

Financiele sturing

Ondanks de hoge prijzen wordt elektriciteit nog altijd door veel bedrijven gezien als een commodity – als een product dat er altijd is en kan worden afgenomen voor een redelijk laag en vast bedrag per maand.

De oorlog in Oekraïne, uitdagingen rond klimaatverandering en andere geopolitiek hebben ons wat dat betreft goed met de neus op de feiten gedrukt: Veel bedrijven konden niet meer rendabel elektriciteit produceren bij de geldende kostprijs, een bedrijfsrisico dat velen niet goed hadden afgedekt. De kosten voor noodzakelijke investeringen om klimaatneutraal te worden zitten daar nog niet eens bij.

Het gebruik van zelf-opgewekte elektriciteit geeft zekerheid, iets dat met het volle energienetwerk niet altijd meer vanzelfsprekend is geworden. Zelf energie opwekken is meestal ook extra voordelig omdat u over uw eigen opwek geen energiebelasting, transportkosten en marge hoeft te betalen aan uw leverancier. In 2022 leverde dit een extra voordeel op van rond de €50 per MWh.

Daarom is het essentieel om een goede en gedetailleerde inzage te hebben in uw elektriciteitsprofiel en om dit tijdig bij te kunnen sturen.

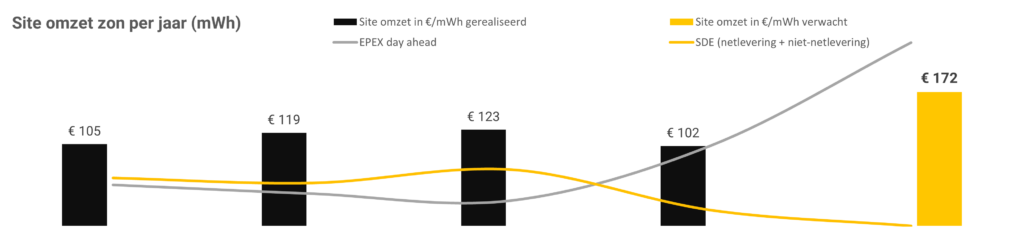

De opbrengst van eigen opwek is afhankelijk van meerdere betrokken partijen en factoren over een periode van 15 jaar of langer. Hierdoor ontbreekt het complete overzicht vaak. Dat maakt het lastig om uw opbrengst te optimaliseren of om bijvoorbeeld verdere investeringen te doen in oplaadpalen of een batterij.

De Encast portal:

De definitieve opbrengsten van uw installatie zijn uiteindelijk afhankelijk van tal van factoren. Encast brengt dit allemaal samen in een overzichtelijke portal om u zo te helpen door de energietransitie heen te navigeren. De uiteindelijke opbrengst van de installatie hangt van allerlei zaken af. Namelijk:

- De SDE-voorschotten van de Rijksdienst voor Ondernemen (RVO). Deze hangen af van het toegekende basisbedrag waarop u heeft ingeschreven, de basisprijs en ook van de verhouding stroom die u teruglevert aan het net en die u zelf gebruikt of doorverkoopt op locatie;

- Eventuele downtime kosten (door storing en onderhoud);

- De voorlopige en definitieve correctiebedragen. Deze worden jaarlijks vastgesteld door het Planbureau voor de Leefomgeving (PBL) en zijn afhankelijk van de gemiddelde marktprijs voor stroom en de profiel- en onbalansfactor.

- De voorlopige en definitieve correctiebedragen. Deze worden jaarlijks vastgesteld door het Planbureau voor de Leefomgeving (PBL) en zijn afhankelijk van de gemiddelde marktprijs voor stroom en de profiel- en onbalansfactor.

(Met forecasting die een lagere onbalans oplevert dan vastgesteld door het PBL kunt u uw opbrengst verhogen.)

- Het weer en de operationele performance.

- De kwaliteit van het advies van uw energieadviseur of leverancier (LV) en hoe regelmatig u advies krijgt;

- De besparing op energiebelasting, transportkosten en de marge van uw leverancier bij het verhogen van uw eigen gebruik.

- De mogelijkheid om energie op te slaan in een elektrische auto of externe batterij en de mogelijkheid om die te kunnen laden en ontladen.

- De daadwerkelijke opbrengst van de verkoop van opgewekte stroom via uw leverancier, de kosten die deze hiervoor in rekening brengt en de kwaliteit van diens forecasting voor u onbalans kosten;

- Door de forecasts van meerdere productielocaties te combineren kunt u extra portfolio voordeel halen. Uw onbalanskosten zijn dan doorgaans lager.

- En achteraf de settlements die verrekend worden als het definitieve correctiebedrag en de jaarlijkse GVO-vergoeding zijn vastgesteld door het PBL en als uw verbruik en levering aan het net is vastgesteld door CertiQ.

Veel van deze zaken worden inzichtelijker dankzij de portal van Encast.

Financiële sturing

Financiële sturing is mogelijk als u een dynamisch energiecontract heeft. In het geval van Encast bij een energieleverancier waar u zelf (of Encast namens u) uw forecast kan aanleveren.

Met een forecast kunt u een positie nemen op de day-aheadmarkt, die de energie van morgen verkoopt. Een forecast is nooit 100% sluitend en het verschil wordt uitgedrukt in onbalans.

De tarieven op de onbalansmarkt van TenneT fluctueren veel heftiger dan die op de day ahead markt. Onbalans is een groeiende kostenpost voor elke producent. Flexibiliteit, voorspelkracht en inzicht wordt dus steeds waardevoller op het net en op de energiemarkten.

Verdien wel 25% extra op een zonnecentrale via onbalans

Als er te veel stroom is op het elektriciteitsnetwerk dan gaat TenneT afregelen en kan de prijs op de onbalansmarkt negatief worden. Dat betekent dat geld betaald wordt om energie te verbruiken of op te wekken. Dit scenario komt steeds vaker voor en is al gemeengoed tijdens zonnige weekenden en feestdagen.

Op die momenten betaalt TenneT dan aan partijen die extra stroom afnemen ten opzichte van hun forecast. Iedere organisatie kan extra verdienen door de productie van de eigen opwek grotendeels te stoppen en extra stroom te gebruiken vanuit het elektriciteitsnetwerk. Op basis van haar modellen is Encast in staat om stuursignalen te geven om hierop te reageren:

Curtailment sturing: indien uw zonnecentrale of windmolen over een daarvoor geschikte curtailment gateway beschikt (wat interessant is vanaf 300kWp), dan kan Encast uw zonnecentrale of windmolen helpen afschakelen.

U produceert dan minder elektriciteit ten opzichte van de positie die u op basis van de forecast heeft ingenomen op de Day ahead markt en haalt dan (op papier) extra stroom van de markt. Hier krijgt u nogmaals voor betaald.

In de tweede helft van 2022 was het mogelijk de opbrengst op die manier met meer dan 55 euro per MWh te verhogen. Dit is rond de 25% extra voor een zonnecentrale.

Encast kan u ook via een API informeren wanneer het slim is om uw elektriciteitsverbruik te verhogen of juist te verlagen, om hier op de onbalansmarkt extra aan te verdienen. Het is dus slim om te kijken of u uw bedrijfsprocessen die veel energie verbruiken kunt flexibiliseren en stuurbaar kunt maken. Een goed voorbeeld hiervan is bijvoorbeeld het opladen van elektrische auto’s of heftrucks, de vriezers harder laten vriezen of juist minder hard op andere momenten.

Copyright 2023